All Categories

Featured

Table of Contents

For lots of people, the largest trouble with the boundless financial idea is that first hit to early liquidity triggered by the costs. This con of limitless financial can be minimized significantly with appropriate plan design, the first years will constantly be the worst years with any kind of Whole Life plan.

That said, there are specific boundless financial life insurance policy plans developed largely for high very early cash money value (HECV) of over 90% in the first year. Nonetheless, the long-lasting performance will often considerably lag the best-performing Infinite Banking life insurance policy policies. Having accessibility to that additional 4 numbers in the first few years might come with the price of 6-figures down the road.

You actually get some substantial long-lasting advantages that assist you recover these very early prices and then some. We locate that this prevented early liquidity issue with limitless financial is much more psychological than anything else as soon as completely checked out. If they definitely required every cent of the money missing from their limitless banking life insurance coverage plan in the initial few years.

Tag: limitless banking concept In this episode, I discuss funds with Mary Jo Irmen that instructs the Infinite Financial Idea. This subject might be debatable, however I intend to obtain varied views on the show and find out about various approaches for farm monetary administration. Several of you might concur and others won't, but Mary Jo brings a really... With the surge of TikTok as an information-sharing platform, financial recommendations and strategies have actually discovered an unique means of dispersing. One such approach that has been making the rounds is the infinite banking idea, or IBC for short, gathering recommendations from celebs like rapper Waka Flocka Flame. However, while the approach is currently popular, its origins trace back to the 1980s when economic expert Nelson Nash introduced it to the world.

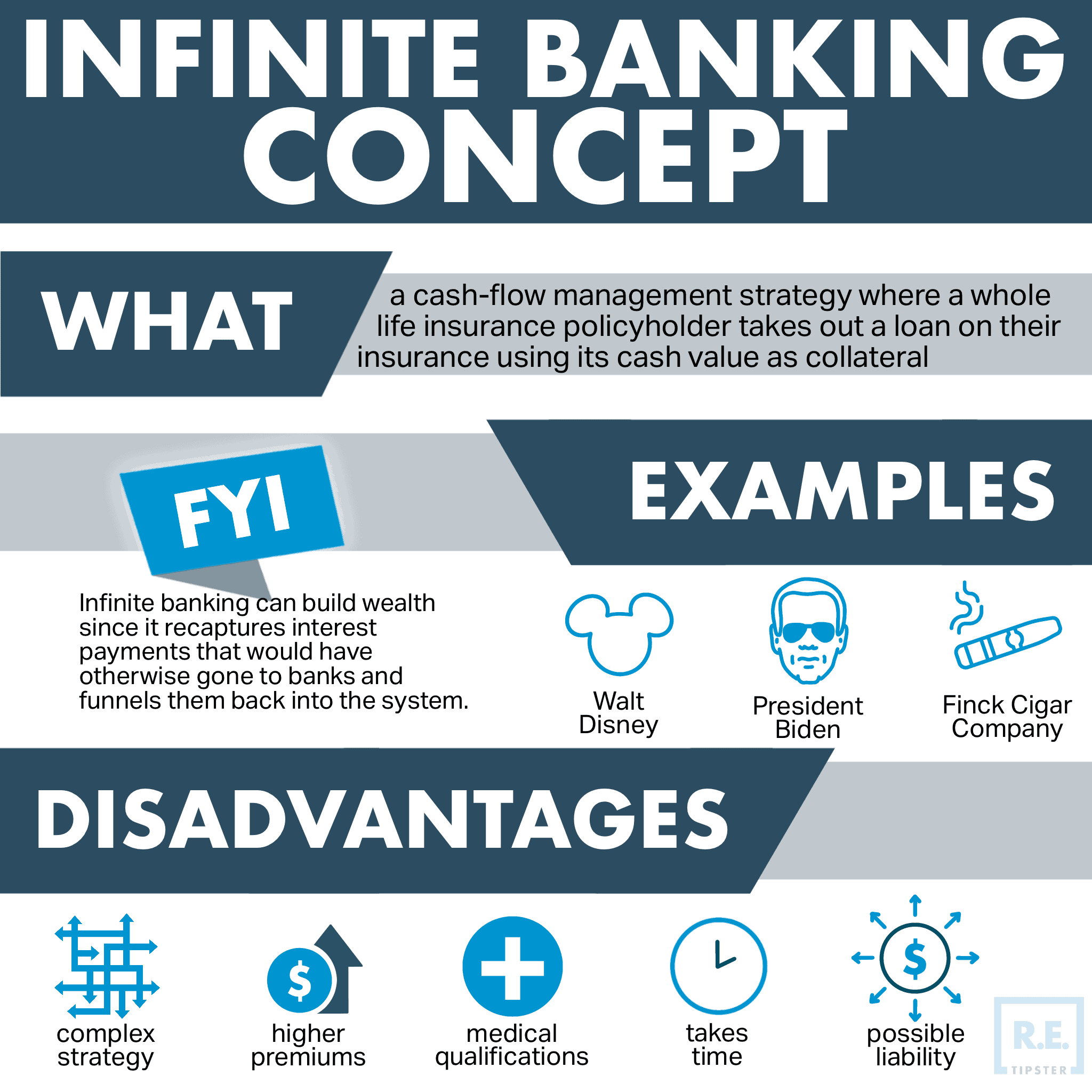

Within these plans, the cash money worth grows based on a price set by the insurance firm. As soon as a substantial cash worth builds up, insurance holders can obtain a money worth finance. These lendings differ from traditional ones, with life insurance offering as collateral, implying one might lose their protection if loaning excessively without adequate money worth to sustain the insurance coverage prices.

And while the attraction of these policies is obvious, there are natural limitations and risks, demanding attentive cash worth monitoring. The method's authenticity isn't black and white. For high-net-worth individuals or entrepreneur, particularly those utilizing techniques like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance growth can be appealing.

Privatized Banking Concept

The appeal of unlimited financial does not negate its difficulties: Price: The fundamental demand, a permanent life insurance policy plan, is more expensive than its term counterparts. Eligibility: Not every person gets approved for entire life insurance policy due to strenuous underwriting procedures that can omit those with particular health and wellness or lifestyle conditions. Intricacy and threat: The elaborate nature of IBC, paired with its risks, may deter several, specifically when simpler and much less high-risk alternatives are offered.

Assigning around 10% of your regular monthly earnings to the plan is just not practical for a lot of people. Part of what you check out below is merely a reiteration of what has actually already been said over.

So before you get yourself right into a situation you're not prepared for, recognize the adhering to first: Although the idea is typically sold therefore, you're not actually taking a lending from yourself. If that were the instance, you would not have to repay it. Instead, you're obtaining from the insurance provider and need to repay it with rate of interest.

Some social media sites blog posts recommend using cash worth from whole life insurance policy to pay for bank card financial obligation. The concept is that when you pay back the financing with interest, the quantity will certainly be returned to your financial investments. Sadly, that's not exactly how it functions. When you repay the lending, a section of that rate of interest mosts likely to the insurance provider.

For the very first numerous years, you'll be repaying the commission. This makes it extremely hard for your plan to build up worth throughout this moment. Whole life insurance policy costs 5 to 15 times extra than term insurance. Many people merely can not manage it. So, unless you can afford to pay a couple of to numerous hundred bucks for the following years or even more, IBC will not benefit you.

Royal Bank Infinite Avion Travel Insurance

If you require life insurance policy, below are some important tips to think about: Consider term life insurance policy. Make sure to go shopping around for the best rate.

Copyright (c) 2023, Intercom, Inc. () with Scheduled Font Style Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Booked Font Name "Montserrat".

Infinite Banking Concept Explained

As a certified public accountant focusing on realty investing, I've cleaned shoulders with the "Infinite Banking Idea" (IBC) extra times than I can count. I have actually even interviewed specialists on the topic. The primary draw, in addition to the obvious life insurance policy advantages, was constantly the idea of accumulating money value within a long-term life insurance plan and loaning against it.

Sure, that makes good sense. But truthfully, I always thought that cash would certainly be much better spent directly on financial investments instead than channeling it through a life insurance policy plan Until I discovered just how IBC can be combined with an Irrevocable Life Insurance Count On (ILIT) to develop generational riches. Let's start with the basics.

Privatized Banking Policy

When you borrow against your plan's money value, there's no set payment routine, offering you the flexibility to handle the financing on your terms. The cash money worth continues to grow based on the policy's warranties and returns. This setup permits you to gain access to liquidity without interrupting the long-term development of your plan, offered that the finance and interest are taken care of wisely.

As grandchildren are born and grow up, the ILIT can purchase life insurance coverage plans on their lives. Household members can take finances from the ILIT, making use of the money worth of the policies to money investments, begin services, or cover significant expenses.

A critical aspect of handling this Family members Financial institution is using the HEMS criterion, which stands for "Wellness, Education, Maintenance, or Assistance." This guideline is frequently included in trust agreements to direct the trustee on just how they can distribute funds to beneficiaries. By sticking to the HEMS standard, the trust fund guarantees that circulations are created important needs and long-lasting assistance, securing the count on's assets while still attending to member of the family.

Enhanced Flexibility: Unlike rigid small business loan, you manage the settlement terms when obtaining from your own plan. This permits you to structure settlements in such a way that straightens with your service capital. a life infinite. Better Money Circulation: By financing organization expenditures through policy car loans, you can potentially free up cash money that would certainly or else be locked up in typical funding payments or equipment leases

He has the same devices, but has likewise developed extra cash money worth in his plan and received tax benefits. And also, he now has $50,000 readily available in his plan to use for future opportunities or expenses., it's important to see it as even more than simply life insurance coverage.

Be My Own Banker

It's about creating a versatile funding system that gives you control and supplies multiple benefits. When used tactically, it can complement various other financial investments and company approaches. If you're intrigued by the capacity of the Infinite Banking Principle for your business, here are some actions to take into consideration: Enlighten Yourself: Dive much deeper into the concept through reliable books, seminars, or consultations with educated professionals.

Table of Contents

Latest Posts

Be Your Own Bank

Becoming Your Own Bank

Be Your Own Bank: Practical Tips

More

Latest Posts

Be Your Own Bank

Becoming Your Own Bank

Be Your Own Bank: Practical Tips